Artikel Terkait What is CRM in Insurance and Why Does It Matter?

- Understanding Insurance: A Guide To Different Policy Types

- Insurance CRM With Cloud Storage: A Comprehensive Guide

- Auto Insurance CRM: Streamlining Operations And Enhancing Customer Experience

- CRM Systems: The Key To Success For Insurers In A Digital Age

- Insurance CRM With Workflow Automation: Streamlining Operations And Enhancing Customer Experience

What is CRM in Insurance and Why Does It Matter?

In today's fast-paced and competitive insurance market, standing out from the crowd requires more than just offering competitive premiums. It's about building strong, lasting relationships with your customers. That's where Customer Relationship Management (CRM) comes into play.

What is CRM? A Simple Definition

At its core, CRM is a strategy and a set of technologies that businesses use to manage and analyse customer interactions and data throughout the customer lifecycle. The goal is to improve business relationships, assist in customer retention, and drive sales growth.

Think of it as a central hub where all information about your customers – from their contact details and policy information to their past interactions and preferences – is stored and managed. This allows your team to provide personalised service, anticipate customer needs, and ultimately, build stronger relationships.

CRM Isn't Just Software

While CRM software is a vital component, it's important to remember that CRM is more than just a piece of technology. It's a business philosophy, a way of thinking that puts the customer at the heart of everything you do. It involves aligning your processes, people, and technology to deliver a consistently excellent customer experience.

Why is CRM Crucial for Insurance Companies?

The insurance industry is built on trust and relationships. Customers entrust you with protecting their assets and their future. In return, they expect you to understand their needs, provide clear and helpful advice, and be there for them when they need you most. Here's why CRM is essential for insurance companies:

Enhanced Customer Experience:

-

Personalisation: CRM allows you to tailor your communication and offers to each customer's specific needs and preferences. Imagine being able to greet a customer by name, instantly access their policy information, and offer relevant advice based on their life stage and circumstances.

-

Improved Communication: CRM streamlines communication across all channels – email, phone, social media, and in-person interactions. This ensures that customers receive consistent and timely responses, no matter how they choose to contact you.

-

Faster Service: With all customer information readily available in one place, your team can resolve issues more quickly and efficiently. This reduces wait times and improves customer satisfaction.

-

-

Increased Sales and Revenue:

-

Lead Management: CRM helps you track and manage leads from initial contact to conversion. You can identify the most promising leads, nurture them with targeted marketing campaigns, and close more deals.

-

Cross-Selling and Upselling: By understanding your customers' existing policies and needs, you can identify opportunities to cross-sell additional products or upsell to higher coverage levels.

-

Improved Sales Forecasting: CRM provides valuable data on sales trends, customer behaviour, and market conditions. This allows you to make more accurate sales forecasts and allocate resources effectively.

-

-

Better Customer Retention:

-

Proactive Service: CRM enables you to anticipate customer needs and proactively address potential issues before they escalate. For example, you can send reminders about policy renewals or offer advice on how to reduce premiums.

-

Loyalty Programmes: CRM can be used to manage loyalty programmes and reward customers for their continued business. This helps to build customer loyalty and reduce churn.

-

Feedback Management: CRM allows you to collect and analyse customer feedback, identify areas for improvement, and address any complaints or concerns promptly.

-

-

Improved Operational Efficiency:

-

Automation: CRM automates many routine tasks, such as sending emails, generating reports, and updating customer records. This frees up your team to focus on more strategic activities.

-

Data Centralisation: CRM centralises all customer data in one place, eliminating the need for manual data entry and reducing the risk of errors.

-

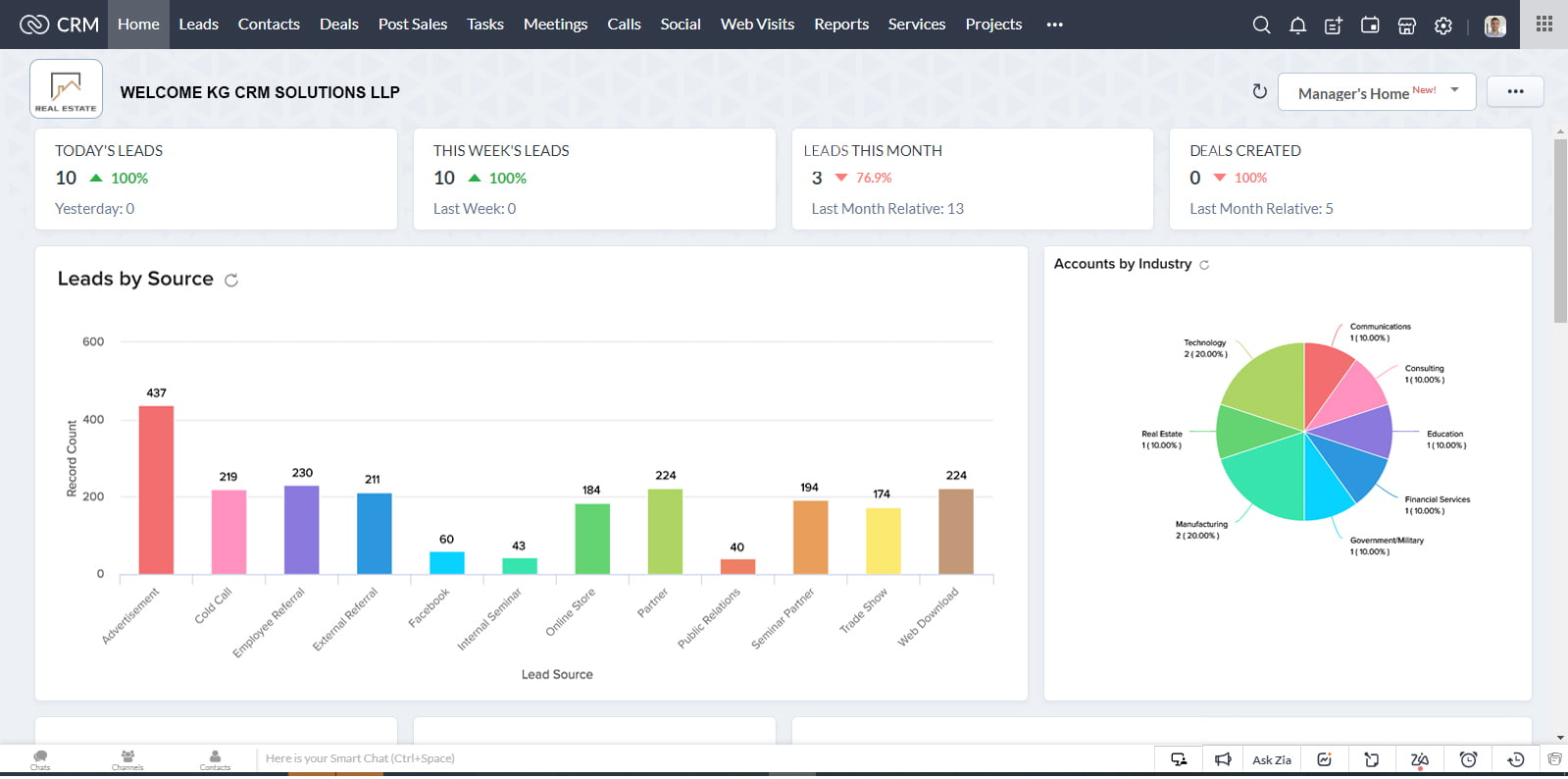

Reporting and Analytics: CRM provides powerful reporting and analytics tools that allow you to track key performance indicators (KPIs), identify trends, and make data-driven decisions.

-

Key Features of a CRM System for Insurance

When choosing a CRM system for your insurance business, look for these essential features:

-

Contact Management: A robust contact management system is the foundation of any CRM. It should allow you to store and manage detailed information about your customers, including their contact details, policy information, and communication history.

-

Policy Management: The CRM should be able to integrate with your policy administration system to provide a complete view of each customer's policies, coverage levels, and premiums.

-

Lead Management: A lead management module helps you track and manage leads from initial contact to conversion. It should allow you to segment leads, assign them to sales representatives, and track their progress through the sales pipeline.

-

Sales Automation: Sales automation features can help you streamline your sales process, automate routine tasks, and improve sales efficiency. This may include features such as automated email campaigns, quote generation, and commission tracking.

-

Marketing Automation: Marketing automation features allow you to create and manage targeted marketing campaigns to attract new customers and retain existing ones. This may include features such as email marketing, social media marketing, and lead nurturing.

-

Customer Service: A customer service module helps you manage customer inquiries, resolve issues, and provide excellent customer service. This may include features such as a knowledge base, ticketing system, and live chat.

-

Reporting and Analytics: Robust reporting and analytics tools are essential for tracking KPIs, identifying trends, and making data-driven decisions. The CRM should provide a range of reports and dashboards that give you insights into your sales performance, customer behaviour, and marketing effectiveness.

-

Integration: The CRM should integrate seamlessly with your other business systems, such as your policy administration system, accounting system, and marketing automation platform.

Choosing the Right CRM for Your Business

With so many CRM systems available, choosing the right one for your business can be a daunting task. Here are some factors to consider:

-

Business Needs: What are your specific business needs and goals? What problems are you trying to solve with a CRM system?

-

Budget: How much are you willing to spend on a CRM system? Consider both the upfront costs and the ongoing maintenance and support fees.

-

Scalability: Will the CRM system be able to scale as your business grows?

-

Ease of Use: Is the CRM system easy to use and intuitive? Will your team be able to learn it quickly and effectively?

-

Integration: Does the CRM system integrate with your other business systems?

-

Support: What level of support is provided by the CRM vendor?

Examples of CRM Systems Used in the Insurance Industry

- Salesforce: A leading CRM platform that offers a wide range of features and integrations for the insurance industry.

- Microsoft Dynamics 365: Another popular CRM platform that integrates seamlessly with other Microsoft products.

- Zoho CRM: A more affordable CRM option that is suitable for small and medium-sized insurance businesses.

- Insightly: A CRM specifically designed for small businesses, with a focus on simplicity and ease of use.

Tips for Implementing a CRM System

-

Define Your Goals: Before you start implementing a CRM system, clearly define your goals and objectives. What do you want to achieve with the CRM?

-

Get Buy-In: Get buy-in from all stakeholders, including your sales team, customer service team, and management.

-

Train Your Team: Provide comprehensive training to your team on how to use the CRM system.

-

Start Small: Start with a pilot project to test the CRM system and identify any issues.

-

Monitor and Adjust: Monitor the performance of the CRM system and make adjustments as needed.

The Future of CRM in Insurance

The future of CRM in insurance is bright. As technology continues to evolve, CRM systems will become even more sophisticated and powerful. Here are some trends to watch:

-

Artificial Intelligence (AI): AI is being used to automate tasks, personalise customer interactions, and provide insights that can help insurance companies make better decisions.

-

Cloud Computing: Cloud-based CRM systems are becoming increasingly popular because they are more affordable, scalable, and accessible.

-

Mobile CRM: Mobile CRM allows insurance agents to access customer information and manage their tasks from anywhere, at any time.

-

Social CRM: Social CRM allows insurance companies to engage with customers on social media and build relationships with them.

Conclusion

In conclusion, CRM is an essential tool for insurance companies that want to build strong relationships with their customers, increase sales, and improve operational efficiency. By choosing the right CRM system and implementing it effectively, you can gain a competitive advantage and thrive in today's challenging insurance market. It's an investment in your customers, your team, and the future of your business.